Ach Processing Fundamentals Explained

Table of ContentsNot known Details About Ach Processing Ach Processing Can Be Fun For EveryoneThe 8-Second Trick For Ach ProcessingLittle Known Questions About Ach Processing.

A lot more recently nevertheless, banks have pertained to enable exact same day ACH repayments or next-day ACH transfers that take only one to two company days. So as lengthy as the electronic settlements request is submitted before the cutoff for the day, it's possible for the money to be gotten within 24 hr - ach processing.Whatever kind of ACH settlements are included, a transfer is a process of 7 steps, which starts with the cash in one account as well as finishes with the money getting here in one more account. ACH repayments begin when the begetter (payer)begins the process by asking for the transaction. The pioneer can be a consumer, service, or a government company.

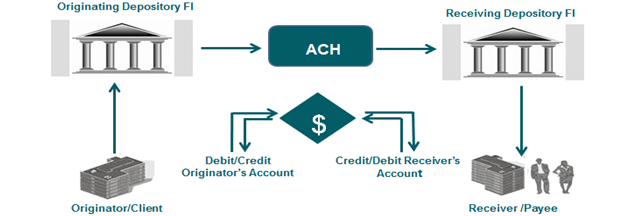

Once a purchase is started, an entrance is sent by the financial institution or settlement processor taking care of the first phase of the ACH payments procedure. The financial institution or repayment cpu is called the Originating Depository Financial Organization (ODFI). Monetary organizations often send out ACH access in batches, typically 3 times a day throughout normal organization hours.

Reserve bank as well as the EPN are national ACH drivers. Once received, an ACH driver types the batch of entrances into down payments and also settlements, as well as settlements are after that sorted into ACH credit rating as well as debit settlements. This guarantees that money is moved in the appropriate direction. After sorting entrances, the ACH driver sends them to their destined financial institution or economic institution, called an Obtaining Vault Financial Organization (RDFI).

See This Report about Ach Processing

Ultimately, when obtaining ACH payments, the getting banks either credit histories or debits the receiving savings account, depending on the nature of the deal. While the total cost related to approving ACH settlements differs, ACH fees are typically more affordable than the fees related to approving card repayments. One of the greatest cost-influencers of accepting ACH repayments is the quantity of purchases your organization intends to process.

When accessing ACH indirectly with a Third Party Repayment Cpu (TPPP), a variety of types of charges might be entailed: While both cord transfers (like SWIFT) as well as ACH repayments permit for digital repayment of funds to checking account, the major distinction is that wire transfers are utilized to facilitate international payments, whereas digital ACH repayment is only offered domestically. Whether you're an acquirer, settlements processor or vendor, it's essential to be able to gain full real-time presence into your repayments ecosystem. Improperly executing systems enhance disappointment throughout the whole repayments chain. It can cause lengthy lines up, the chance of clients abandoning purchases, and also frustration from customers badly impacting income.

IR Transact streamlines the intricacy of managing modern repayments environments, consisting of ACH repayments. Bringing real-time presence and also repayment monitoring to your whole atmosphere, Negotiate uncovers unparalleled understandings right into ACH transactions and also repayments patterns to help you streamline the payments experience, transform information right into knowledge, and assure the settlements that maintain you in business.

:max_bytes(150000):strip_icc()/what-does-ach-stand-for-315226_FINAL-a68079317cfb403aaa73cab72e1762ab-5e4dff6edf83427e8d8b85b9ed9617e3.jpg)

The Greatest Guide To Ach Processing

When you move money to your close friend's account, ever before wondered exactly how it functions? What really takes place behind the scenes? Opportunities are you have already used ACH settlements, however are not knowledgeable about the lingo. go right here Some of the instances of ACH purchases include: Online costs settlements with your savings account, Moving cash from one bank account to one more, Paying vendors or getting cash from consumers by means of direct deposit, Straight down payment payroll to a worker's monitoring account used by business, Allow's explore he has a good point ACH settlement processing a lot more carefully.

, ACH repayments per day surpassed 100 million in February 2019. 1% rise in ACH purchase quantity for the very first quarter of 2020, with B2B repayments uploading an 11.

You transfer money to a Silicon Valley Bank account from your Financial institution of America account. Both the financial institutions have to credit score and also debit each various other's accounts.

In this manner, the fund transfer occurs simply as soon as. ACH is one such main clearing up system for financial institutions in the US. It operates using 2 clearing up centers: the Reserve bank and also The Clearing up Residence. Cord transfers are interbank digital repayments. While cable transfers seem to be similar to ACH transfers, here his response are some essential differences between them: Can take a couple of organization days, Instantaneous, Free for a receiver, small charges ($1) for a sender, Both the sender as well as receiver are charged fees.

The 2-Minute Rule for Ach Processing

Can be challenged if conditions are fulfilled, As soon as started, can not be canceled/disputed, No human treatment, Normally entails teller, Both send out and request payments. For settlement demands, you require to submit the ACH documents to your financial institution. Only send settlements, Processed in sets, Refined real-time, A cable transfer is perfect for you when time is of the significance, while ACH processing is a much better alternative for non-mission-critical and reoccuring payments. Currently in any transfer, two individuals are involved.

Your consumer authorizes you to debit their financial institution account on his behalf for repeating deals. Allow's claim Jekyll needs to pay an amount of $100 to Hyde (assume they're two different people) as well as makes a decision to make a digital transfer. Below is a detailed breakdown of exactly how a bank transfer by means of ACH jobs.

Comments on “Ach Processing Can Be Fun For Anyone”